ΣΧΟΛΙΟ ΙΣΤΟΛΟΓΙΟΥ : Το ρολογάκι της Τουρκίας άρχισε να χτυπάει..τικ-τακ...τικ-τοκ (άντε παιδιά καλοφάγωτα)...και μπορεί οι Αμερικανοί να μην έχουν πρόβλημα με τη χώρα Τουρκία..αλλά μόνο με τον Ερντογάν , αλλά η

Τουρκία έχει πρόβλημα με τους Αμερικανούς! Ένα πολύ μεγάλο ποσοστό των

Τούρκων θεωρεί τις ΗΠΑ εχθρική χώρα. Ίσως θα πρέπει να ανοίξουν τα μάτια τους , και να δουν την αλήθεια...σχετικά με την Τουρκία οι Δυτικοί.

As short-term risks are building for Turkish equities with the delivery of a Russian missile defense system that has drawn the threat of U.S. sanctions, option traders are bracing for losses.

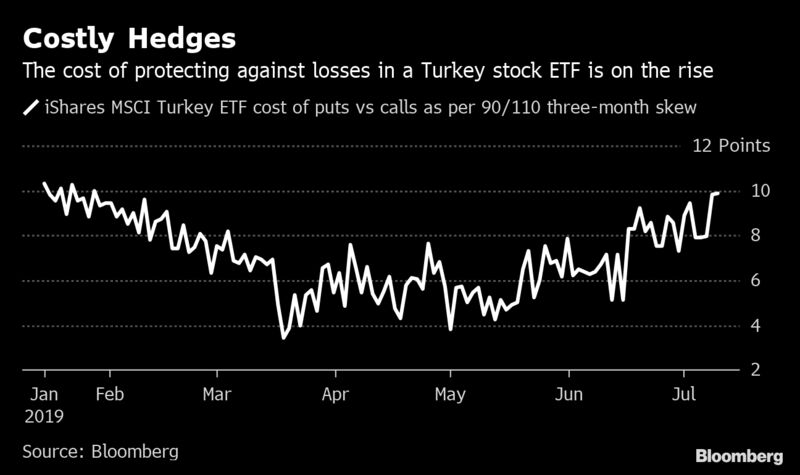

During the run-up to Friday’s delivery of the first batch of the S-400 missile system parts, options data showed the cost of hedging against declines in the largest exchange-traded fund tracking Turkish stocks has climbed to the highest level since late January. Outflows from the the iShares MSCI Turkey ETF reached $163.2 million this year, with the bearish bets climbing to a record high.

Turkey’s purchase of the S-400 system has been a source of market bearishness this year as it threatens its relations with the U.S. While a meeting between the presidents of the two countries stoked speculation about milder sanctions and propped up the nation’s stocks, it failed to keep bears entirely at bay until the full extent of the sanctions became clear. Add to that the increased chances of rate cuts following the ouster of Turkey’s central bank head Murat Cetinkaya.

Turkey Clings to Trump Bump as Clock Ticks Over Russian Missiles

Investors are keeping their caution as Turkey receives the S-400s and after the recent central bank appointment which took the governor job away from a technocrat, Michel Danechi, a fund manager at Vedra Partners, said. The recent dismissal at the bank have fueled faster-than-expected rate cuts and they have to be “slow and orthodox for the whole thing to work.”

Turkey’s Emergency Central Banker Trapped in a Catch-22 on Rates

The BIST 100 Index dropped 0.6% on Friday, snapping a two-day gain. The benchmark has this year trailed a global stock rally fueled by bets of easier monetary policy in the U.S. While the delivery of the missiles caused a knee-jerk reaction in the nation’s assets on Friday, it is a question of “how punitive” possible sanctions will be and when they are implemented, according to Investec trader Julian Rimmer.

“Only then will we know whether this is seriously detrimental to the investment case for Turkish assets,” he said.

πηγή

As short-term risks are building for Turkish equities with the delivery of a Russian missile defense system that has drawn the threat of U.S. sanctions, option traders are bracing for losses.

During the run-up to Friday’s delivery of the first batch of the S-400 missile system parts, options data showed the cost of hedging against declines in the largest exchange-traded fund tracking Turkish stocks has climbed to the highest level since late January. Outflows from the the iShares MSCI Turkey ETF reached $163.2 million this year, with the bearish bets climbing to a record high.

Turkey’s purchase of the S-400 system has been a source of market bearishness this year as it threatens its relations with the U.S. While a meeting between the presidents of the two countries stoked speculation about milder sanctions and propped up the nation’s stocks, it failed to keep bears entirely at bay until the full extent of the sanctions became clear. Add to that the increased chances of rate cuts following the ouster of Turkey’s central bank head Murat Cetinkaya.

Turkey Clings to Trump Bump as Clock Ticks Over Russian Missiles

Investors are keeping their caution as Turkey receives the S-400s and after the recent central bank appointment which took the governor job away from a technocrat, Michel Danechi, a fund manager at Vedra Partners, said. The recent dismissal at the bank have fueled faster-than-expected rate cuts and they have to be “slow and orthodox for the whole thing to work.”

Turkey’s Emergency Central Banker Trapped in a Catch-22 on Rates

The BIST 100 Index dropped 0.6% on Friday, snapping a two-day gain. The benchmark has this year trailed a global stock rally fueled by bets of easier monetary policy in the U.S. While the delivery of the missiles caused a knee-jerk reaction in the nation’s assets on Friday, it is a question of “how punitive” possible sanctions will be and when they are implemented, according to Investec trader Julian Rimmer.

“Only then will we know whether this is seriously detrimental to the investment case for Turkish assets,” he said.

πηγή

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου